All Categories

Featured

Table of Contents

[/image][=video]

[/video]

If you're in great wellness and prepared to undergo a clinical examination, you may qualify for standard life insurance at a much reduced expense. Surefire problem life insurance is typically unnecessary for those in good health and can pass a clinical examination.

Offered the reduced coverage amounts and greater premiums, assured problem life insurance coverage may not be the most effective alternative for long-term financial preparation. It's typically a lot more suited for covering final costs as opposed to replacing earnings or considerable financial debts. Some guaranteed concern life insurance coverage policies have age constraints, often restricting candidates to a particular age range, such as 50 to 80.

Guaranteed concern life insurance comes with higher premium prices contrasted to clinically underwritten plans, but prices can differ significantly depending on aspects like:: Different insurance business have different pricing versions and may supply various rates.: Older candidates will certainly pay greater premiums.: Ladies frequently have reduced rates than males of the exact same age.

: The death benefit quantity influences premiums. A $25,000 policy prices much less than a $50,000 policy.: Paying costs monthly expenses a lot more general than quarterly or annual payments.: Entire life premiums are higher total than term life insurance plans. While the ensured issue does come at a price, it offers essential protection to those that may not receive typically underwritten policies.

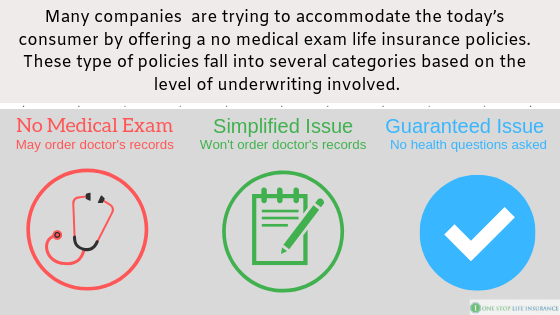

Surefire problem life insurance policy and streamlined concern life insurance policy are both kinds of life insurance that do not need a medical examination. There are some essential distinctions in between the 2 types of plans. is a kind of life insurance policy that does not require any type of health concerns to be answered.

The 2-Minute Rule for Term Life Insurance – Get A Quote

Guaranteed-issue life insurance plans typically have greater costs and lower fatality benefits than conventional life insurance policy plans. The health inquiries are commonly less detailed than those asked for standard life insurance coverage plans.

Today, experts can evaluate your info rapidly and concern an insurance coverage decision. In many cases, you may even have the ability to get immediate insurance coverage. Instantaneous life insurance policy coverage is insurance coverage you can obtain an instant response on. Your plan will begin as quickly as your application is accepted, meaning the whole process can be done in much less than half an hour.

Immediate coverage just uses to call plans with increased underwriting. Second, you'll need to be in excellent wellness to qualify. Several internet sites are promising immediate insurance coverage that starts today, however that doesn't indicate every applicant will certify. Often, consumers will certainly send an application thinking it's for instant coverage, only to be consulted with a message they require to take a clinical examination.

The exact same info was then made use of to accept or reject your application. When you apply for a sped up life insurance coverage plan your data is assessed instantaneously.

You'll after that obtain instantaneous authorization, immediate denial, or see you require to take a medical examination. You might need to take a clinical examination if your application or the data drew concerning you expose any type of wellness problems or issues. There are numerous options for immediate life insurance policy. It is necessary to keep in mind that while numerous standard life insurance firms deal sped up underwriting with fast approval, you could require to experience an agent to use.

The Greatest Guide To Guaranteed Issue Life Insurance

The business below offer totally online, straightforward alternatives. They all supply the opportunity of an immediate decision. Ladder policies are backed by Fidelity Safety Life. The business offers flexible, instant plans to individuals between 18 and 60. Ladder plans allow you to make changes to your coverage over the life of your policy if your needs change.

The business offers policies to applications in between 21 and 55 for a ten-year term, and in between 21 and 45 for a 20-year term. You'll obtain an instantaneous choice from Bestow. There are no medical examinations needed for any kind of applications. Ethos policies are backed by Legal and General America. The business does not supply policies to citizens of New York state.

Simply like Ladder, you may require to take a clinical examination when you apply for protection with Values. Unlike Ladder, your Values policy will not begin right away if you require a test.

In various other cases, you'll need to supply more details or take a medical test. Right here is a price contrast of insant life insurance coverage for a 50 year old man in great wellness.

Many individuals start the life insurance buying plan by getting a quote. Allow's claim you got a quote for $50 a month for a $500,000, 20-year policy.

You can establish the specific protection you're applying for and after that start your application. A life insurance coverage application will ask you for a lot of information.

Aarp Guaranteed Life Insurance From New York Life Fundamentals Explained

If the company finds you didn't reveal details, your plan might be refuted. The decline can be shown in your insurance coverage score, making it harder to get insurance coverage in the future.

A simplified underwriting policy will certainly ask you detailed inquiries regarding your clinical background and current medical care during your application. An instant concern policy will certainly do the very same, yet with the difference in underwriting you can get an instantaneous choice.

And also, ensured problem plans aren't able to be used during the waiting duration. For many policies, the waiting period is two years.

If you're in great health and wellness and can qualify, an instantaneous concern plan will certainly permit you to get protection with no examination and no waiting period. In that instance, a streamlined issue policy with no examination might be best for you.

How No Exam Life Insurance [Instant & Free Quotes] can Save You Time, Stress, and Money.

Bear in mind that simplified issue plans will take a few days, while immediate policies are, as the name implies, instant. Acquiring an immediate plan can be a quick and simple process, but there are a few things you ought to watch out for. Prior to you hit that purchase button ensure that: You're getting a term life policy and not an unexpected fatality policy.

They do not provide protection for ailment. Some business will release you an unintentional death plan quickly yet need you to take an exam for a term life policy. You've checked out the small print. Some sites contain vivid photos and vibrant pledges. See to it you read all the details.

Your representative has addressed all your questions. Much like internet sites, some representatives emphasize they can get you covered today without explaining or supplying you the details you need.

Latest Posts

Unknown Facts About Compare No Exam Life Insurance Quotes Instantly

9 Simple Techniques For Life Insurance

Guaranteed Issue Life Insurance Can Be Fun For Everyone